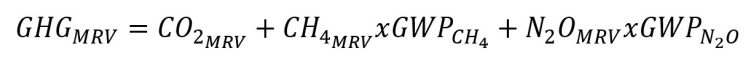

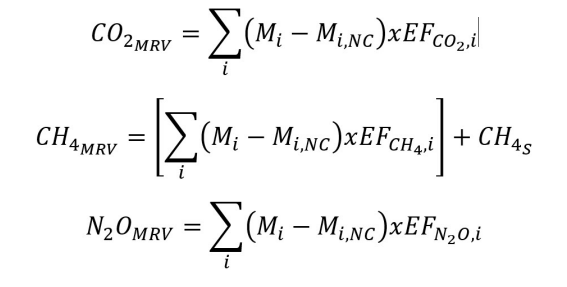

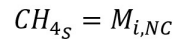

In the above formulas, EFCO2,i, EFCH4,I and EFN2O¬,I are the Tank to Wake CO2, CH4 and N2O emission factors by fuel type I, as defined in the table under point 2 of Part A of the Delegated Regulation. CH4S is the amount of CH4 non combusted released into the atmosphere, which can should be calculated as:

What parameters must be monitored to report the CH4 and N2O emissions?

For typical liquid MGO / HFO, only the calculation approach is used and no additional parameters must be monitored. However, for burning LNG, segregation of the amount of fuel consumption per emissions source will be needed due to different methane slip depending on the engine type.

Is it advisable to have the amended monitoring plan, to include also CH4 and N₂O, prepared in 2023?

Yes, it is advisable to develop or revise the EU MRV Monitoring Plan to include the CH4 and N2O emissions in 2023 and it is recommended to submit the plan for verification by the end of 2023 to ensure enough time for the assessment due by April 1, 2024.

What is the purpose of the total emissions cap at the EU level?

The EU Emissions Trading System (ETS) is a ‘cap-and-trade’ system. The cap is the threshold defining the total amount of greenhouse gases that can be emitted by all operators covered by the system (energy, manufacturing, transport, etc.). It is reduced annually, at fixed intervals, in line with the EU’s climate target: this is the so-called ‘linear reduction factor’. The reduction of total Emission Allowances will lead to competition and increase in price for each ton of GHG emissions allowance if all the economic operators cannot meet their GHG reduction targets and demand outpaces supply of EUAs.

Can brokers participate in the primary market, auctioning in the EEX platform?

The only entity that can participate in the primary market is the operator covered in EU ETS. Brokers, however, can buy spot EUAs and futures.

What is the minimum lot for Over-the-Counter (OTC) trading?

The minimum size is 500 EUAs for ABN, matching minimum lot size of the EEX auctioning. At ICE exchange the daily EUA future is 1,000 EUAs (1,000 EUAs = 1 future).

Who is responsible for operating the Maritime Operator Holding Account (MOHA)?

The shipping company which is defined as “The shipowner or any other organization or person, such as the manager or the bareboat charterer, that has assumed the responsibility for the operation of the ship from the shipowner, and by assuming such responsibility has agreed to take over all the duties and responsibilities imposed by the ISM”, is to establish a Maritime Operator Holding Account.

A shipping company is registered in the Marshall Islands (MI). Could owners use their management company, situated in Greece as the responsible entity for surrendering EUAs?

Shipping company is defined as “The shipowner or any other organization or person, such as the manager or the bareboat charterer, that has assumed the responsibility for the operation of the ship from the shipowner, and by assuming such responsibility has agreed to take over all the duties and responsibilities imposed by the ISM”, therefore the manager can be the responsible entity for surrendering the EUAs. According to the Commission Implementing Regulation laying down rules for the application of Directive 2003/87/EC as regards the administration of shipping companies by administering authorities in respect of a shipping company, the country of registration of a shipping company as referred to in Article 3gf of Directive 2003/87/EC shall be the country recorded in Thetis MRV, the dedicated Union information system that supports the implementation of Regulation (EU) 2015/757.

A shipping company is registered in GISIS in Liberia, although it is based in Greece. Depending on the visited EU ports the last two calendar years, the administering authority can change accordingly. How is it possible to change the country of registration in GISIS?

Would it be possible to send comments through ABS to the IMO for the Concept Note on administering authorities? The administrating authority for companies not registered in the EU is determined by:

1. In the case of a shipping company that is not registered in a member State, the member State with the greatest estimated number of port calls from voyages performed by that shipping company in the preceding four monitoring years and falling within the scope set out in Article 3ga of EU ETS Directive;

2. In the case of a shipping company that is not registered in a member State and that did not carry out any voyage falling within the scope set out in Article 3ga in the preceding four monitoring years, the member State where a ship of the shipping company has started or ended its first voyage falling within the scope set out in that Article.

According to the Commission Implementing Regulation laying down rules for the application of Directive 2003/87/EC as regards the administration of shipping companies by administering authorities in respect of a shipping company, the country of registration of a shipping company as referred to in Article 3gf of Directive 2003/87/EC shall be the country recorded in Thet is MRV, the dedicated Union information system that supports the implementation of Regulation (EU) 2015/757.

How can a shipping company identify its assigned administering authority?

Each shipping company is assigned to one administering authority in one Member State, in accordance with Article 3gf of the Directive 2003/87/EC .

The European Commission through Implementing Decision 2024/411 published a list of all shipping companies , which have performed an activity falling under the EU ETS on or with effect from 1 January 2024, and their respective administering authorities.

The list will be updated:

- Every two years after 1 February 2026 and for companies registered in an EEA state.

- By 1 February and every four years after, for non-EEA companies attributed to a Member State.

On 5 December 2025, the European Commission issued the Implementing Decision (EU) 2025/2452, updating the list of shipping companies attributed to EU ETS Administering Authorities (AA) based on the latest Thetis-MRV data. The updated list applies from 1 January 2026.

What if based on the Implementing Decision (EU) 2025/2452 there is a change in the assigned AA?

If there is a change in your assigned AA, you may contact the new AA promptly to confirm vessel lists and compliance arrangements, and address monitoring plans approval and MOHA requirements.

What if a shipping company is not included in the published lists?

If one of the company’s ships has performed an activity falling under the EU ETS , but the shipping company is not yet found on European Commission’s published lists, it can identify their administering authority via the THETIS-MRV system.

Would it be possible for the shipowner to surrender the allowances directly and not via the DoC holder?

As per the definition of “shipping company” which is “The shipowner or any other organization or person, such as the manager or the bareboat charterer, that has assumed the responsibility for the operation of the ship from the shipowner, and by assuming such responsibility has agreed to take over all the duties and responsibilities imposed by the ISM”, the ship owner can be the responsible party for surrendering the allowances.

Do the EU allowances (EUAs) expire?

Allowances may be purchased anytime, but the number of allowances to cover the verified emissions must be surrendered by September 30 following the reporting year. There is no expiry date for the EU allowances (EUAs).

How will the EU ETS cost affect the charterers?

The ETS Directive provides for the entitlement of reimbursement to the shipping company for the costs of the pollution liabilities incurred by the controlling entity, for example the charterer.

Can shipowners have access to the EEX platform where they can buy their EU allowances?

The entity responsible for surrendering allowances, the shipping company, is the one that can participate in the primary market, the EEX platform and buy EU allowances. To do so, the shipping company shall open a Maritime Operator Holding Account in the Union Registry. Shipping company is defined as “The shipowner or any other organization or person, such as the manager or the bareboat charterer, that has assumed the responsibility for the operation of the ship from the shipowner, and by assuming such responsibility has agreed to take over all the duties and responsibilities imposed by the ISM”.

One of the main concerns of shipowners is to ensure that they will be reimbursed from the charterers for the cost of EUAs. When will national legislation ensure that shipowners are not liable for any default by charterers?

The entitlement for reimbursement is to be provided for when the EU member States transpose the requirements of the ETS Directive into their own national legislation: Firstly, the member States are to provide for a statutory right to this entitlement for reimbursement in their national law and secondly they are to assure the corresponding access to judicial enforcement in case there is a default in the other entity reimbursing the shipping company.

What statutory rights do owners have to be able to recover EU ETS related costs from charterers in the context of time charters?

Shipping companies and entities responsible for the purchase of the fuel and/or the operation of the ship are expected to develop contractual clauses to pass on the ETS surrendering costs as appropriate. Regardless of contractual arrangements, EU member States must take national measures to ensure that the shipping company is entitled to reimbursement in such situations and must provide corresponding access to justice to enforce this entitlement.

What are the legal requirements for each entity (shipping company or charterer) based on the type of charter contract (Spot, Contract of Affreightment (CoA), Time Chartering (T/C))?

The ETS Directive provides for the entitlement of reimbursement to the shipping company for the costs of the pollution liabilities incurred by the controlling entity, for example the charterer. The ETS Directive recognizes that ships owned or managed by a shipping company may be chartered out to another entity in such a fashion that this entity takes control of the ship under a contractual agreement or takes on the responsibility for the purchasing of the fuel for the 14 ship. In this case, while the shipping company still retains the responsibility for surrendering the allowances, the ETS Directive provides for the entitlement of a reimbursement to the shipping company for the costs of the pollution liabilities incurred by the controlling entity, for example the charterer. The individual charter agreement between the shipping company and the charterer will have to be drafted to clearly allocate the responsibilities for the emissions obligations.

Is the same entity responsible for compliance under EU MRV and EU ETS?

Regulation (EU) 2023/957 in paragraph (10) mentions "To ensure coherence in administration and enforcement, the entity responsible for compliance with Regulation (EU) 2015/757 should be the same as the entity responsible for compliance with Directive 2003/87/EC". The draft Implementing Regulation (EU) laying down rules for the application of Directive 2003/87/EC as regards the administration of shipping companies by administering authorities in respect of a shipping company, in paragraph (6) clearly states that "The entities responsible for compliance with the obligations under Regulation (EU) 2015/757 and with the obligations under Directive 2003/87/EC must be clearly identifiable at all times. To this end, and with a view to ensuring coherence in administration and enforcement, Regulation (EU) 2015/757 provides that the same entity must be responsible for both". Therefore, the draft Implementing Regulation does not leave room for misinterpretation and explicitly states that the same entity shall do the EU MRV reporting as well as the EUAs submission.

Will the UK include shipping in the UK ETS from 2024 and onwards?

No, the UK has announced its intention to establish its own ETS scheme. The UK ETS will expand to cover the domestic maritime transport sector from 2026. The scheme will be applicable to large maritime vessels only, of 5000 gross tonnage and above. This will be subject to further consultation on the details of implementation. Expanding the UK ETS to include domestic maritime would require maritime participants to monitor their emissions from eligible journeys, report their emissions from these journeys and surrender sufficient allowances to cover their emissions. This would apply to domestic journeys only, which would be defined as a journey starting and finishing at a port located in the UK. UK ETS is intended to apply to the entity responsible for a vessel’s compliance with the International Safety Management (ISM) Code and to exempt government non-commercial activity.

UK ETS scope expansion: maritime sector - GOV.UK

Are ballast legs covered under EU ETS?

And if so, who is the responsible entity for surrendering EUAs of that voyage? Ballast voyages, from the last port of call where the ship has discharged cargo to the next port of call where cargo is loaded, also serve the purpose of transporting cargo and are therefore subject to the Regulation. The responsible entity for surrendering the emissions corresponding to the ballast voyage is the shipping company. However, the ETS Directive provides for the entitlement of reimbursement to the shipping company for the costs of the pollution liabilities incurred by the controlling entity, for example the charterer.

MRV is voyage based, whereas EU ETS is calendar based. Does this bring any required modifications for the EU MRV plan?

The MRV requirements have been amended and are aligned with EU ETS calendar-based reporting. The monitoring plan will need to be amended to acknowledge that whenever a voyage takes place across two consecutive calendar years (i.e. part of the voyage falls in year N, and part in year N+1), the voyage fuel oil consumption during the previous year shall be reported in the emissions report of that specific year, while the consumption occurring in the upcoming year should be included in the emissions report for that corresponding year.

Reported emissions are subject to verifier verification. Do the EUAs have to be verified as well?

The purchasing or surrendering of EUAs is not subject to verification activities by the verifier – this is between the shipping company and the administering authority. The administering authority shall ensure that a shipping company under its responsibility monitors and reports the relevant parameters during a reporting period, submits to it aggregated emissions data at company level, surrenders relevant EUAs and remains compliant with the EU ETS requirements.

How can we ensure a smooth transfer of the EUAs from the Trading Account to the Maritime Operator Holding Account (MOHA)? Is it possible for the MOHA to trade allowances like the Trading Account?

A Maritime Operator Holding Account is necessary for all shipping companies covered in EU ETS, and shall be opened from January 1, 2024, after submitting a request to the National Administration of the Administering Authority. A MOHA corresponds to a Trading Account except for the additional functionalities such as the surrendering of allowances. A Trading Account can be opened by private individuals, companies as well as operators that want to trade on the EU ETS market.

How can the price of EUAs be regulated and capped?

The price of EUAs is self-regulated, dependent on the market dynamics created by the cap-and�trade system. To resolve situations of high volatility, the EU has established the Market Stability Reserve (MSR). Its purpose is to improve the system’s resilience to major shocks, meaning situations where the price of EUAs is very low or very high. For the first case, the MSR reduces the auctioning volume by deducting EUAs from the market, whereas for the second case, supplies additional EUAs.

EUAs price seem volatile. What would ABS suggest to shipping companies in that matter?

There are many analysts in the market, suggesting that EUAs will pass €100 in the next year. It is important for shipping companies to be reimbursed of the EU ETS costs soon after the end of the chartering period. ABS, as an independent verifier, can support shipowners by providing validation services of the taxed emissions on a voyage level, that can be shared with the entities responsible for purchase of the fuel and/or the operation of the ship and request the transfer of the equivalent amount of EUAs. *The foregoing should not be construed as legal advice