Frequently Asked Questions

1. Why has the UK introduced its own MRV regime?

After Brexit, on January 31, 2020, the United Kingdom (U.K.) transposed the EU legislation into UK law through Statutory Instrument 2018/1388, establishing the UK MRV regime. This regime mirrors the EU MRV framework and aims to monitor, report, and verify emissions data from ships calling at UK ports.

2. How are biofuels treated and reported under UK MRV?

Biofuels and bioliquids, which are certified as sustainable under schemes recognized by the European Commission in accordance with the Renewable Energy Directive II (Directive (EU) 2018/2001), may be assigned a CO2 emission factor of zero. For blends, the CO2 emission factor should be based on the mass-weighted average of the emission factors for the respective fuels.

3. Should voyages between a UK port and an EU port be reported under both regimes?

To avoid duplication, voyages between UK and EEA ports (and vice versa) are not to be recorded under the UK MRV regime. Data on these voyages should continue to be submitted to the European Commission under the EU MRV regime.

Only the emissions generated during UK port stays related to these voyages are to be reported in the UK MRV Emissions Report.

4. Should voyages to/ from ports in UK Overseas Territories and Crown Dependencies be reported under the UK MRV?

Ports in the UK Overseas Territories and Crown Dependencies are not considered UK ports under the UK MRV regime. Accordingly, voyages between two Crown Dependencies or Overseas Territories or from a port in an Overseas Territory or Crown dependency to a non-UK port should not be included.

However, voyages between a port in the UK and a port in one of the UK Overseas Territories or Crown Dependencies shall be reported under the UK MRV regime.

5. Should voyages to/from Port of Akrotiri (CYAKT) and Dhekelia (CY DHK) be reported under UK MRV or EU MRV?

Although the Ports of Akrotiri and Dhekelia are geographically located in Cyprus, they fall under the jurisdiction of British Overseas Territory. As such, they should be treated as non-EU port, under the scope of the EU MRV/ETS and Fuel EU regimes.

Under UK MRV, they are not considered UK ports, as outlined above. Please refer to the above FAQ for more details.

6. How should operators handle monitoring and reporting when a ship changes company during the reporting period?

The Operator should submit a UK monitoring plan to the verifier for the newly acquired ship, no later than two months after the ship’s first call to a UK port.

The new company is responsible for submitting the emissions report for the full calendar year. Therefore, the new company should obtain all necessary data from the previous owner as early as possible to ensure complete and accurate reporting.

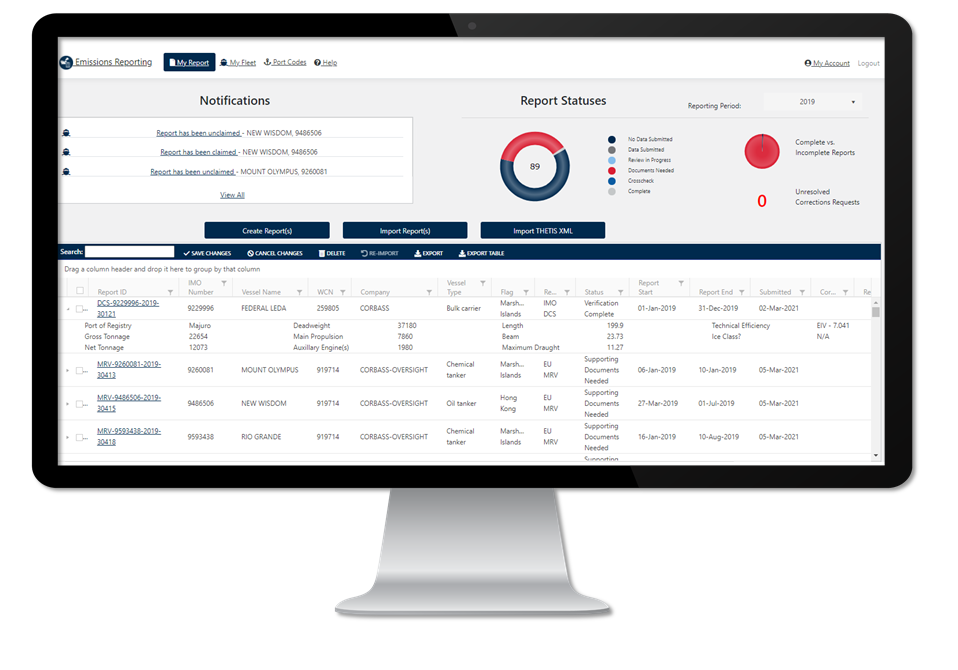

7. How will the UK MRV emissions reports be submitted, since the UK does not have a reporting database?

Ship operators should submit their emission reports each year to a verifier accredited by the United Kingdom Accreditation Service (UKAS) for verification.

Considering that the UK no longer has access to the THETIS-MRV database and is developing its own reporting system, the requirement for ship operators to report the verified emissions is delayed until the digital solution is fully operational. A UK Document of Compliance (DoC) will not be required under UK MRV until then.

Once the UK reporting system is ready:

- Data from any intervening years must be submitted.

- A UK Document of Compliance (DoC) must be available onboard by 30 June each year, confirming submission of a validated emissions report under UK MRV for the previous reporting period. This requirement is in addition to the EU MRV DoC.

8. What emissions will be covered under UK ETS?

The UK ETS will apply to ships of 5,000 GT and above and will cover 100% of carbon dioxide (CO2), methane (CH4) and nitrous oxide (N2O) emissions from the following:

- Between UK ports, including those which start and end at the same port, including emissions while at anchor and while moored.

- Within UK ports, which includes emissions at berth in UK ports and emissions from movements within UK ports, regardless of whether the voyage is domestic or international.

9. Will offshore ships be covered under UK ETS?

In alignment with the EU ETS, the offshore ships will be included in the UK ETS regime from 1 January 2027.

10. Who will be responsible for reporting and surrendering allowances?

The Registered Owner of a ship is the default responsible entity. Under a legally binding agreement, the ISM Company may assume responsibility.

11. Will the emission factors for fuels cover the full lifecycle emissions?

The scheme will use a Tank-to-Wake emissions accounting approach for conventional fuels. Sustainable fuels of biological and non-biological origin will be zero-rated.

12. Should a Document of Compliance (DoC) be carried on board for the purposes of the UK ETS?

No. A Document of Compliance is not required under UK ETS. Compliance is managed by UK ETS regulators through the Manage your Emissions Trading Scheme (METS) system and the UK Emissions Trading Registry.

13. What is the process for submission of verified emissions data to the competent authorities under the UK ETS?

Operators must appoint an independent verifier accredited by the UK Accreditation Service (UKAS) to verify their Annual Emissions Report (AER), which will include emissions from each ship and aggregated data. One AER is required per operator, not per ship.

Verified reports are expected to be submitted through the Manage your UK ETS reporting service (METS).

14. Will an account structure similar to MOHA be established for the UK ETS?

To purchase allowances, operators must hold an account in the UK Emissions Trading Registry. Allowances may be purchased via auctions, or on the secondary market throughout the year in preparation for surrender.

It is understood that a Maritime Operator Holding Account (MOHA) will be introduced in the UK Emissions Trading Registry, mirroring the structure of the EU ETS Union Registry.